About Qadir Collections

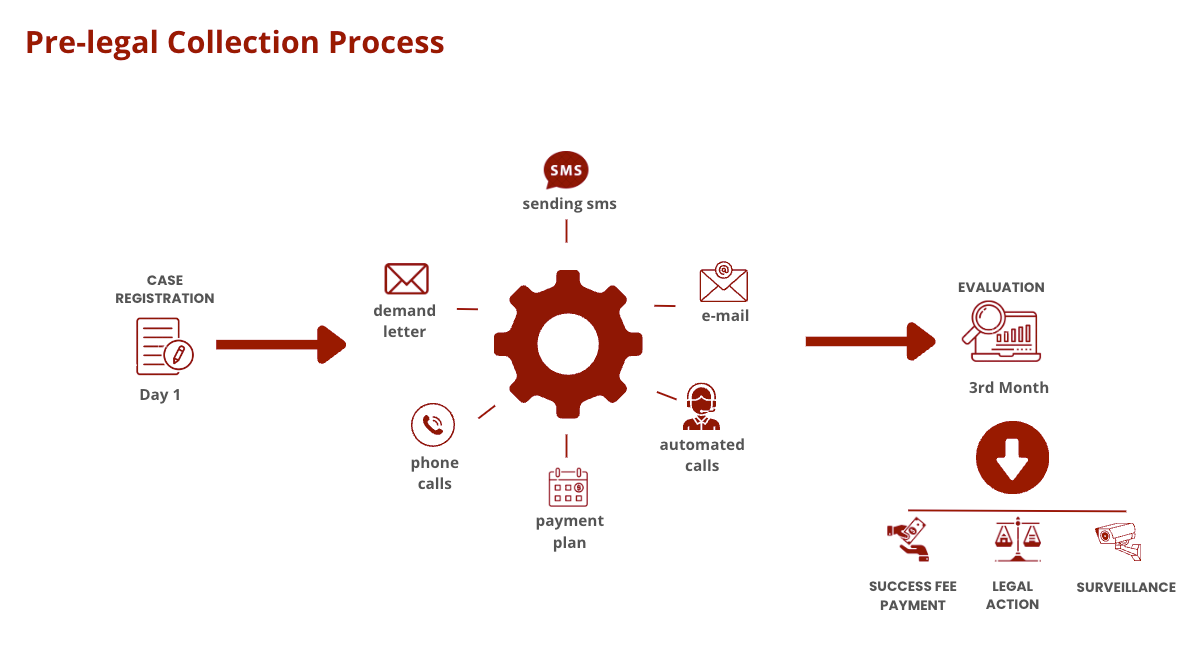

At Qadir Collections, we are at the forefront of global debt recovery, specializing in aiding businesses and individuals worldwide in securing unpaid invoices and delayed payments. Our innovative debt collection platform is renowned globally, catering to clients across the United States and beyond. Our unique strategy welcomes debts of any magnitude, initiating the collection process without necessitating an upfront payment.

We stand by a client-friendly “No successful collection, No fee” policy, ensuring that our services are entirely risk-free. This approach guarantees that our clients are charged only when we deliver successful outcomes. Our mission is to streamline the debt recovery process on a global scale, alleviating the burden and stress associated with chasing overdue payments.

Our approach is deeply rooted in understanding and respecting the diverse cultural and legal landscapes of our clients’ debtor locations. This global perspective allows us to tailor our collection strategies, ensuring maximum effectiveness while maintaining a respectful and ethical stance towards debtors in different countries.

Qadir Collections is dedicated to prioritizing our clients’ needs, adopting a client-centric model that focuses on delivering results-driven success. We leverage our extensive international network, expertise in local laws and customs, and a commitment to ethical practices to recover debts efficiently and effectively.

Mission

“To deliver the most practical debt recovery solutions to our clients by offering a unique and cost-effective debt collection platform, where everyone can use our services on global claims. We strive to maintain the highest ethical and compliant practices.”

Vision

“To continue to expand our reach across global leader in debt recovery, providing our clients with the highest driven results and support no matter where they are. We aim to build long-lasting relationships with our clients and to be the go-to solution for all their debt recovery needs.”

” I started Qadir Collections to make sure you get paid for the services you deserved.”

– Caryn Pamorca

Founder of Qadir Collections

Why Choose Us?

Frequently Asked Questions

CONTACT USHow does a debt collection agency benefit creditors?

A debt collection agency can benefit creditors by increasing the likelihood of successful debt recovery. They have the resources and expertise to track down debtors and negotiate payment. Additionally, using a debt collection agency frees up time and resources for the creditor to focus on their business operations.

What happens if a debt is not paid?

If a debt is not paid, the creditor may turn to a debt collection agency to recover the outstanding amount. The agency will first attempt to contact the debtor and negotiate a payment plan or full repayment. If the debtor continues to default on payments, the agency may take legal action, such as filing a lawsuit or garnishing wages. In some cases, the debt may be written off as uncollectible if it is determined that the debtor is unable to pay. However, it’s important to note that each country has its own laws and regulations regarding debt collection, and in the UAE, there are specific laws and procedures that must be followed by debt collection agencies. It is important to work with a reputable and experienced debt collection agency to ensure compliance with local laws and to maximize the chances of successful debt recovery.

What are the tips of creditors in collection payment?

Creditors can increase their chances of successful debt collection by following a few simple tips.

First, it is important to clearly communicate payment expectations and due dates to the debtor. This sets clear expectations and helps prevent misunderstandings.

Secondly, keeping detailed records of all communication and payments made by the debtor is essential. This documentation can be useful in the event of legal action or disputes.

Thirdly, offering flexible payment options, such as installments or partial payments, can make it easier for the debtor to repay the debt. Additionally, working with a reputable debt collection agency that is familiar with local laws and regulations in the UAE can be extremely beneficial.

Finally, patience and persistence in following up on the debt is important, but it is also important to be understanding of the debtor’s circumstances and consider negotiating a payment plan if necessary. By following these tips, creditors can increase their chances of successful debt recovery and focus on running their business.

What steps can a debtor take to improve their credit score after dealing with a debt collection agency?

To improve their credit score after dealing with a debt collection agency, debtors can repay their outstanding debt, keep track of their credit report and dispute any errors, make all payments on time, keep credit card balances low, and pay down high-interest debt. By following these steps and managing their finances responsibly, debtors can improve their credit score over time and regain control of their financial situation. Consistency and patience are key to successfully rebuilding credit.

What rights do debtors have when dealing with a debt collection agency?

Debtors in the UAE have several rights when dealing with a debt collection, including the right to:

1. Be treated with respect and dignity.

2. Receive written verification of the debt.

3. Challenge the validity of the debt.

4. Have their privacy protected.

5. Not be subjected to abusive or harassing behavior.

It is important to note that debt collection must follow strict laws and regulations in the UAE, including the Central Bank’s regulations on debt collection. Debtors who feel their rights have been violated can file a complaint with the Central Bank or take legal action.

It is important for debtors to be informed of their rights and to work with a reputable debt collection agency that adheres to the local laws and regulations. By understanding their rights, debtors can work with debt collection agencies to resolve their debts in a fair and respectful manner.

Can a debt collection agency help recover debts from outside of the country?

A debt collection agency in the UAE may be able to assist with debt recovery from outside of the country and will depend on the specific circumstances of the case and the laws and regulations in the country where the debt is owed. Debt collection agencies have established networks and relationships with international debt collection agencies, which can facilitate cross-border debt recovery. However, it is important to keep in mind that the laws and regulations governing debt collection can vary greatly from country to country. It helps you determine the best course of action to recover the debt and assist you every step of the way.

Angeline Monali

Commercial Manager, Light Vision

“The debt I needed to collect for my client was complex and required a great deal of negotiation and persistence, but they worked well and were able to get the full payment, thanks to Qadir Collections! ”

Ramon Leonard

Finance Director, Infindex

“I am extremely satisfied with the results I received. They were able to recover the payment I’m struggling to get from one of our customer, which I never would have been able to do on my own.”

Ian Blaire

Founder, Lux Interior

“I was really impressed with the communication and transparency. They kept me updated throughout the entire process and were always available to answer my questions.”

Patrick Felizo

CEO, Blue Dragon

“The process was quick and efficient, I appreciate their professionalism and expertise – highly recommended.”