debt collection

Understanding Debt Collection

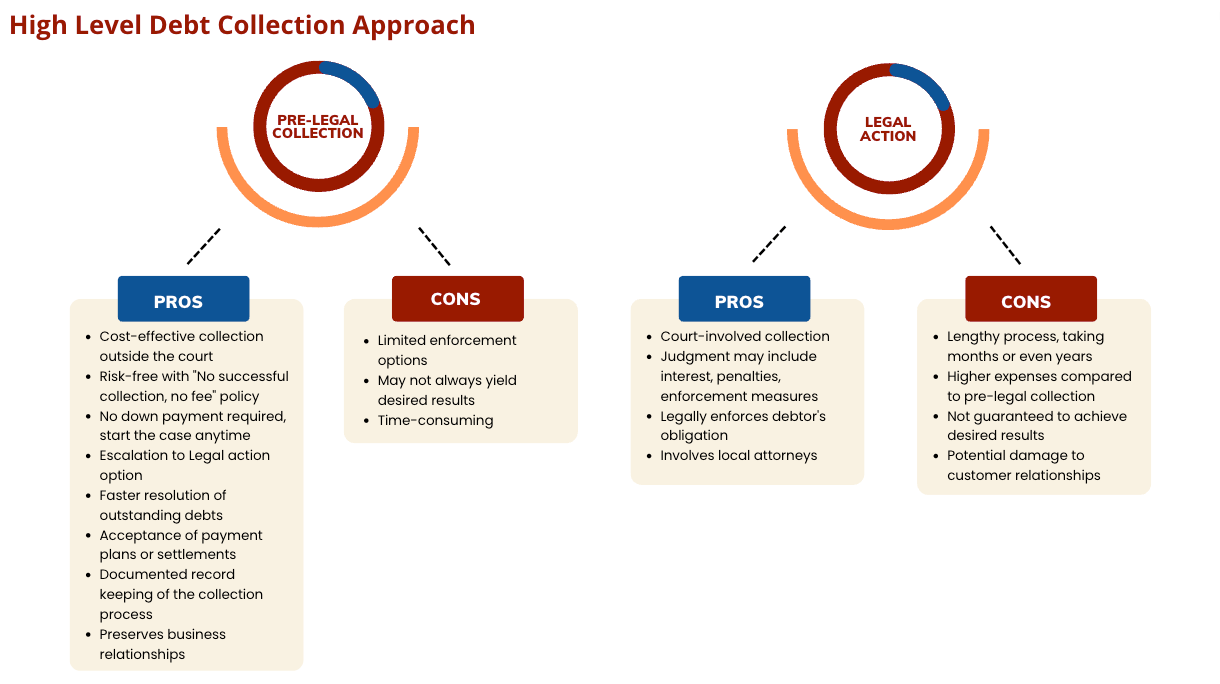

Debt collection involves pursuing and recovering outstanding debts from individuals or businesses. Hiring professional debt collectors is beneficial due to the expertise in effectively communicating with debtors, negotiating payment plans, and taking legal action if needed. It benefits both businesses and individuals by ensuring timely payment, improving cash flow, and reducing financial losses. At Qadir Collections, we offer two effective approaches for debt collection: Pre-legal and Legal Action.

Pre-legal debt collection refers to the initial phase of attempting to collect the debt before taking legal action. This entails debt collection outside of court using non-legal methods. The process is run through various methods such as phone calls, letters, SMS, or emails with the aim of recovering the debt and resolving the outstanding balance.

The creditor may also decide to initiate legal action against the debtor. Legal action debt collection is typically seen as a last resort when other attempts to collect the debt have been unsuccessful. It involves formal legal procedures and can be more time-consuming and costly compared to pre-legal debt collection.

pre-legal debt collection

Pre-legal Collection

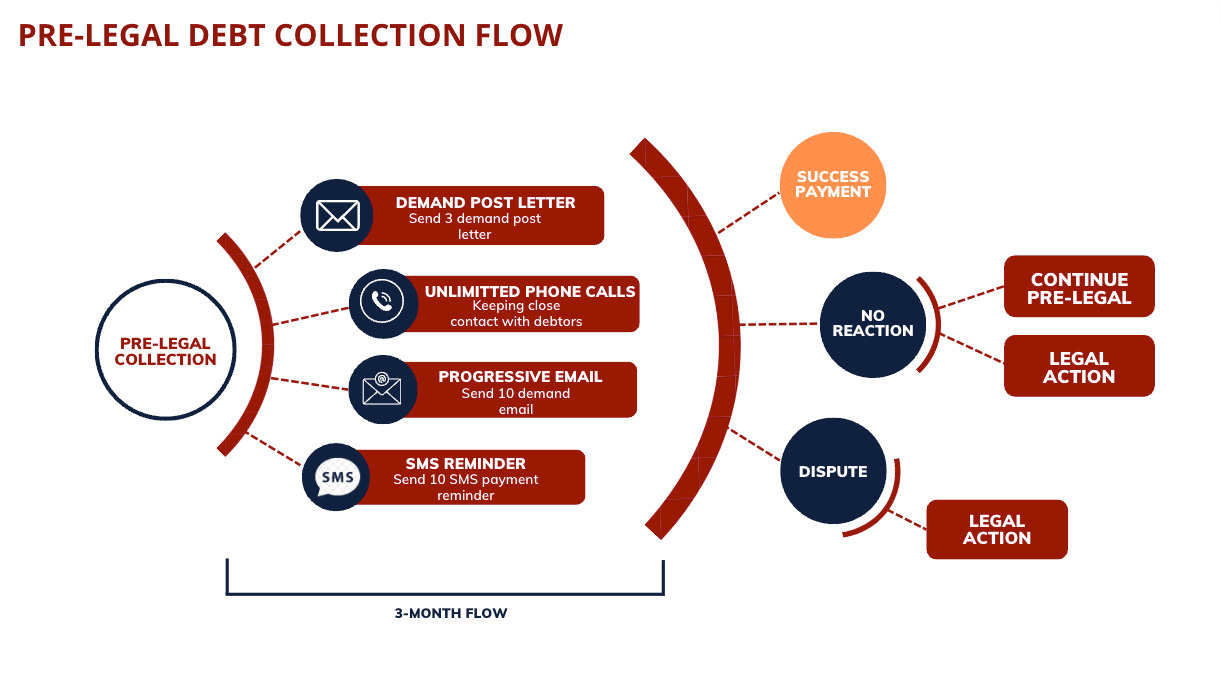

START PRE-LEGALWe operate on a “No successful collection, No Fee” basis for pre-legal debt collection meaning we only charged our clients after a success payment from the debtor. Customers can start the case anytime for free. Pre-legal collection process is specifically designed to be completed within a three-month timeframe.

We begin with a quick pre-check to validate the claim and ensure that the debtor is still active and assess their financial situation. This is followed by communication through various channels, such as customized email, SMS, multiple phone calls, sending physical demand letters and ensure to keep a close contact with the debtor. During the pre-legal debt collection stage, our experienced team contacts the debtor to negotiate repayment terms, including payment plans or settlement agreements if needed.

The focus of this process is recovering outstanding debts without involving the court and the process spans three months which involves multiple contact methods and collection strategies, negotiations, and communication with the debtor to resolve the case.

Our pricing and success fee structure are available at Qadir pricing.

pre-legal debt collection

How It Works

START PRE-LEGAL

During the pre-legal period (3-month process), we will be executing our standard pre-legal debt collection campaign. This is followed by communicating the debtor through various channels such as sending customized emails, progressive SMS, multiple phone call follow-ups, sending physical demand notices, and ensuring to keep a close contact with the debtor. At this stage, our experienced team will work and contact the debtor, and negotiate repayment terms which involve setting up a payment plan or offering a settlement agreement, if necessary until the outstanding debt is settled.

In such cases that remain unresolved within the initial pre-legal period of three months, we provide our customers with the option to proceed with Surveillance (continuous debt collection) or Legal Action. By pursuing with Surveillance collection, the process involves continuous debt collection until the statute of limitations governing the debt has expired.

pre-legal debt collection

What Happens After Pre-legal Collection: Legal Action and Continuous Pre-legal Debt Collection

We have established a pre-legal debt collection process that typically spans a duration of three (3) months from the commencement of the collection efforts. During this period, we employ various communication channels to engage with the debtor and seek to recover the outstanding debt.

In such cases where the pre-legal collection process does not yield the desired results within the three-month timeframe such as debtors either have “No Reaction” or there is a “Dispute”, we will provide our customers with the option to proceed with the subsequent stage of debt collection that involves legal action and continuous pre-legal debt collection.

legal debt collection

Legal Action

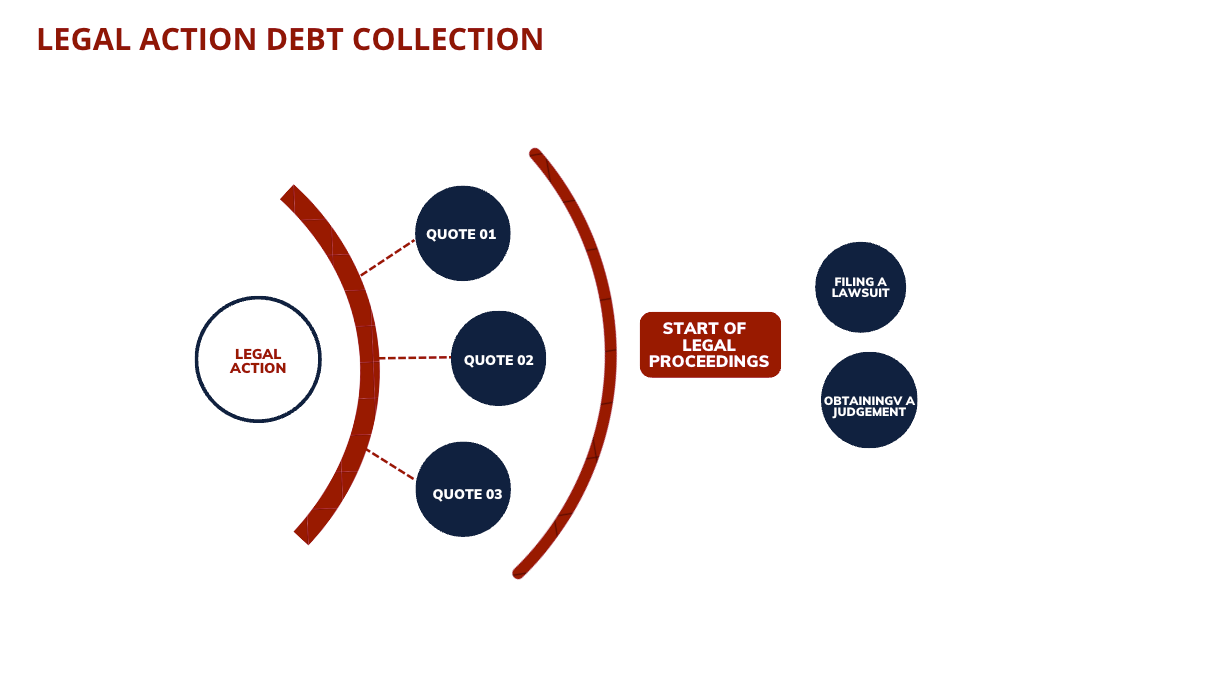

After the pre-legal period, if there is no progress or resolution, the Creditor has the option to proceed with legal action. This is recommended in cases where there are significant disputes with the debtor, communication has ceased, and the debtor has not taken the matter seriously.

Various type of legal action includes filing a lawsuit and obtaining a judgement.

Our local partners will provide the necessary support and expertise in initiating and pursuing legal proceedings. We will provide a quotation for the upfront costs required to start the legal action, ensuring transparency in the process.

legal debt collection

When To Pursue Legal Action

When all other collection methods have been exhausted or the debt is of significant value, pursuing legal action becomes a viable option. It is crucial to carefully assess the circumstances, including the amount of the debt and the debtor’s response, to determine if legal action is the appropriate course of action. Legal action is typically pursued when debtors have shown a lack of cooperation or have failed to respond to previous collection efforts.

Before initiating legal action, it is essential to ensure that all pre-legal collection methods have been utilized, such as sending demand letters and attempting direct communication with the debtor. Reviewing the relevant documentation is significant to establish the validity and enforceability of the debt.

We have established partnerships with local lawyers in various countries. These legal professionals possess in-depth knowledge of their respective jurisdictions’ laws and regulations, enabling us to ensure that all legal actions taken are compliant. Additionally, our collaborations with global law firms allow us to navigate any cross-border legal complexities that may arise during the legal action process.

Legal Cost and Fees

Pursuing legal action can involve various costs and fees, including attorney fees, court costs, and translation fees. The specific costs and fees associated with legal action debt collection can vary depending on the complexity of the case and the jurisdiction in which it is being pursued.

In general, it can be more costly, however, it may be necessary in certain circumstances where other collection methods have failed or the debt is substantial. We advise that the costs and fees will be evaluated on a case-by-case basis and will be subject to consultation with our legal partners.

Duration

The timeline varies based on factors such as case complexity, debtor responsiveness, and the legal system’s efficiency in the jurisdiction.

Legal action process can take several months or even years to resolve, from the initial filing of a lawsuit to the enforcement of a judgment. It is important to provide a case-by-case assessment and consultation to determine the expected timeline and costs associated with pursuing legal action for debt collection.

continuous pre-legal debt collection

Continuous Pre-legal Debt Collection and How It Works

START YOUR CLAIM

The Creditor has the option to proceed with the continuous debt collection. This approach is recommended when the Creditor prefers not to pursue legal action, especially for cases involving smaller amounts where the expenses of legal proceedings may not be justified. This is a continuous collection that involves persistent and assertive efforts to encourage the debtor to settle the outstanding amount until the statute of limitations of the debt is expired. This process can take several months, but we are committed to pursuing it until we achieve success

This is necessary in cases where debtors are unresponsive, uncooperative, or have a history of non-payment. Additionally, if debtors provide false information about their financial situation, the debt is substantial and cannot be written off, or if debtors have moved or are difficult to locate, surveillance action may be warranted. These common factors trigger the need for continuous debt collection efforts to maximize the chances of successful debt recovery.

Throughout the process, our team is dedicated to executing a robust and relentless debt collection strategy. We employ hard debt collection strategy, including unlimited phone calls to the debtor, sending demand emails and multiple SMS reminders, dispatching physical letters, conducting skip tracing, and performing thorough investigations on the debtor’s whereabouts. Our aim is to maintain consistent contact with the debtor and ensure that they are aware of the outstanding debt.